Who moved my chips? Part 1 – Making of a crisis

Two-part series to understand the semiconductor shortages and how to address the challenges to minimize the impact.

We are in the middle of 2021 and the lead times of many semiconductor devices are more than six months. Though some improvement from the peak, challenges would continue for many months. Intel expects shortages to continue for the next two years, clearly, the electronics and semiconductor industry is going through a major disruption.

The gravity of the issue is highlighted by the fact that many major automotive manufacturers including Ford, GM, Daimler Benz, Volkswagen, etc have announced factory shutdowns and lower targets for 2021.

Automotive manufacturers are expected to lose $100B in lost sales in 2021. The automotive industry is worst affected, there are other industries like electronics, medical devices, networking equipment, consumer goods, etc got impacted badly by supply chain challenges.

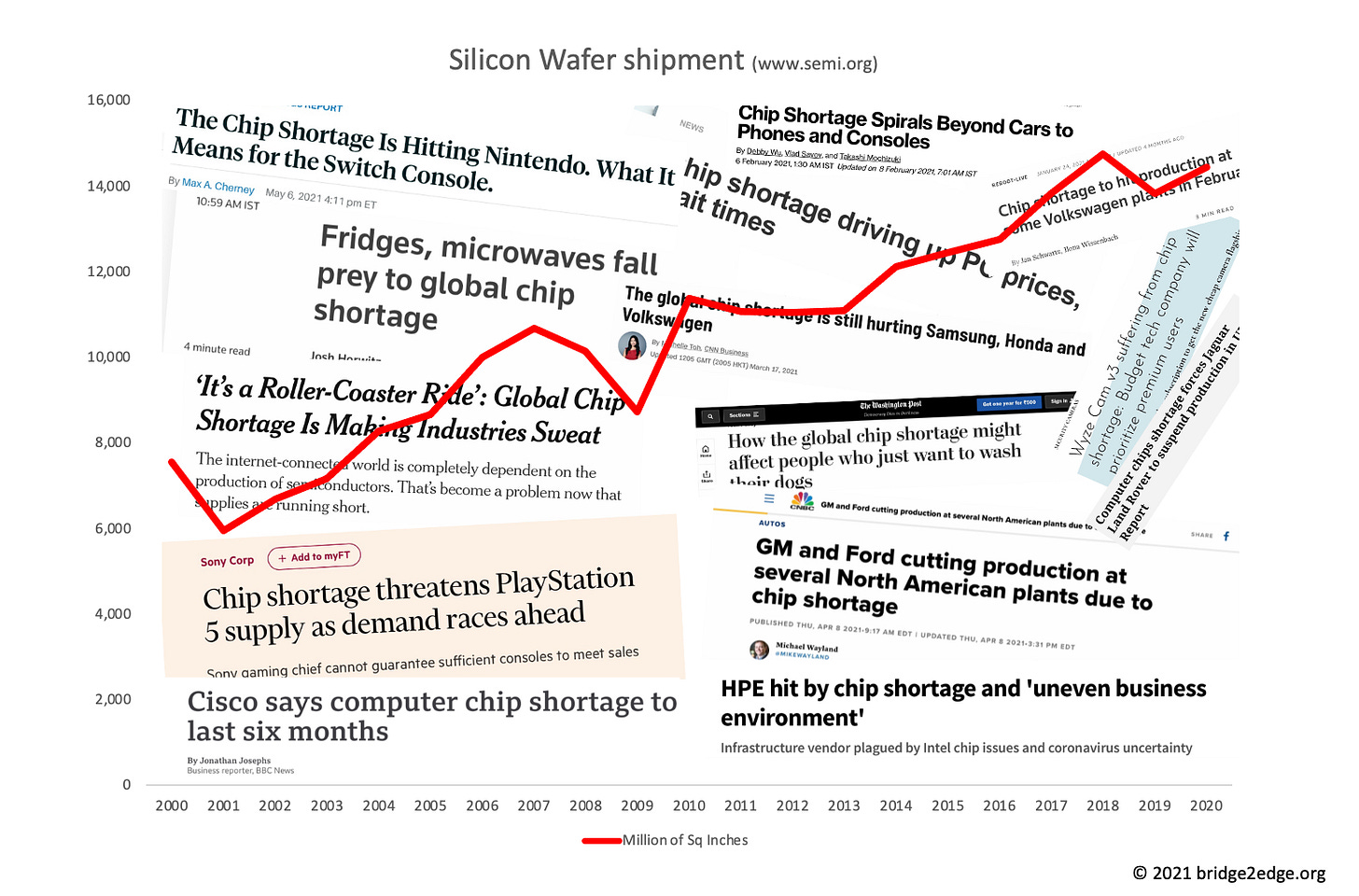

While the world is going through semiconductor supply disruption, the semiconductor industry overall is experiencing strong growth as shown by the growing trend of wafer shipments (www.semi.org). Q1 2021 reported a 14% increase in wafer shipments, to 3,337 million sq inches, compared to last year. Clearly, the pandemic has triggered a massive shift in demand patterns for semiconductor chips and many industries are not ready for this shift.

During the initial stages of the pandemic, the automotive industry and other traditional semiconductor consuming industries started cutting down their orders to semiconductor suppliers as their customer demand dropped.

Semiconductor companies started allocating their available capacity to demand created by the new trend of work-and-study-from-home like cloud computing, consumer electronics, remote healthcare, etc. Unfortunately, when the demand picked up faster than expected for traditional industries, there was no capacity available from the semiconductor companies.

Coupled with this, there was a drought in Taiwan, which affected the semiconductor output. Building new fabs to increase capacity is not only extremely expensive ($3-5 Billion for a typical fab, $20B+ for cutting edge fabs), it could take a couple of years for it to be production-ready.

Even when the pandemic triggered disruption subsides, demand for faster and smaller chips is expected to increase due to 5G expansion, electric vehicles adoption, autonomous vehicles, and IoT applications.

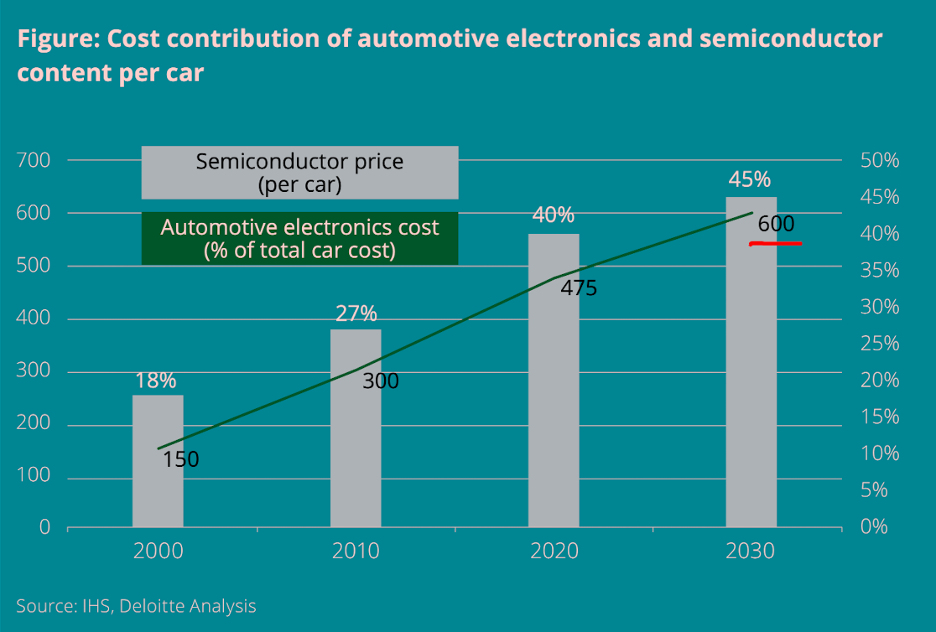

As per this report from Deloitte, automotive electronics is expected to occupy 45% of a car cost and semiconductor cost is going to be $600 per car by 2030. This is critical as semiconductor chips gain prominence in a car but demand from the automotive industry is less than 10% of overall semiconductor volume. The automotive industry is used to see their entire supply chain ecosystem centered around them, it is time to change and develop strategic partnerships with semiconductor suppliers. The situation is the same for other big industries that use semiconductor components.

“The car sector has been used to the fact that the whole supply chain is centered around cars. What has been overlooked is that semiconductor makers actually do have an alternative,” said McKinsey partner Ondrej Burkacky.

Toyota perhaps is the only major automotive player that was not seriously affected by the semiconductor shortage, thanks to the lessons learned from the Fukushima disaster.

They dropped a just-in-time/lean-based inventory policy for critical semiconductor components and stocked up.

Toyota also improved communication/collaboration across all tiers of semiconductor suppliers and did not stop at tier-1 suppliers.

In part 2, would be exploring a 4x2 framework to understand the challenges within Innovate, Plan, Source, and Make management processes within the supply chain. Also, explore multiple ways to address the challenges at the strategic and tactical levels.