Who moved my chips? Part 2 – Weathering the storm

In this final part of the series let us look into a framework to understand various approaches to address the supply chain challenges related to chip shortage.

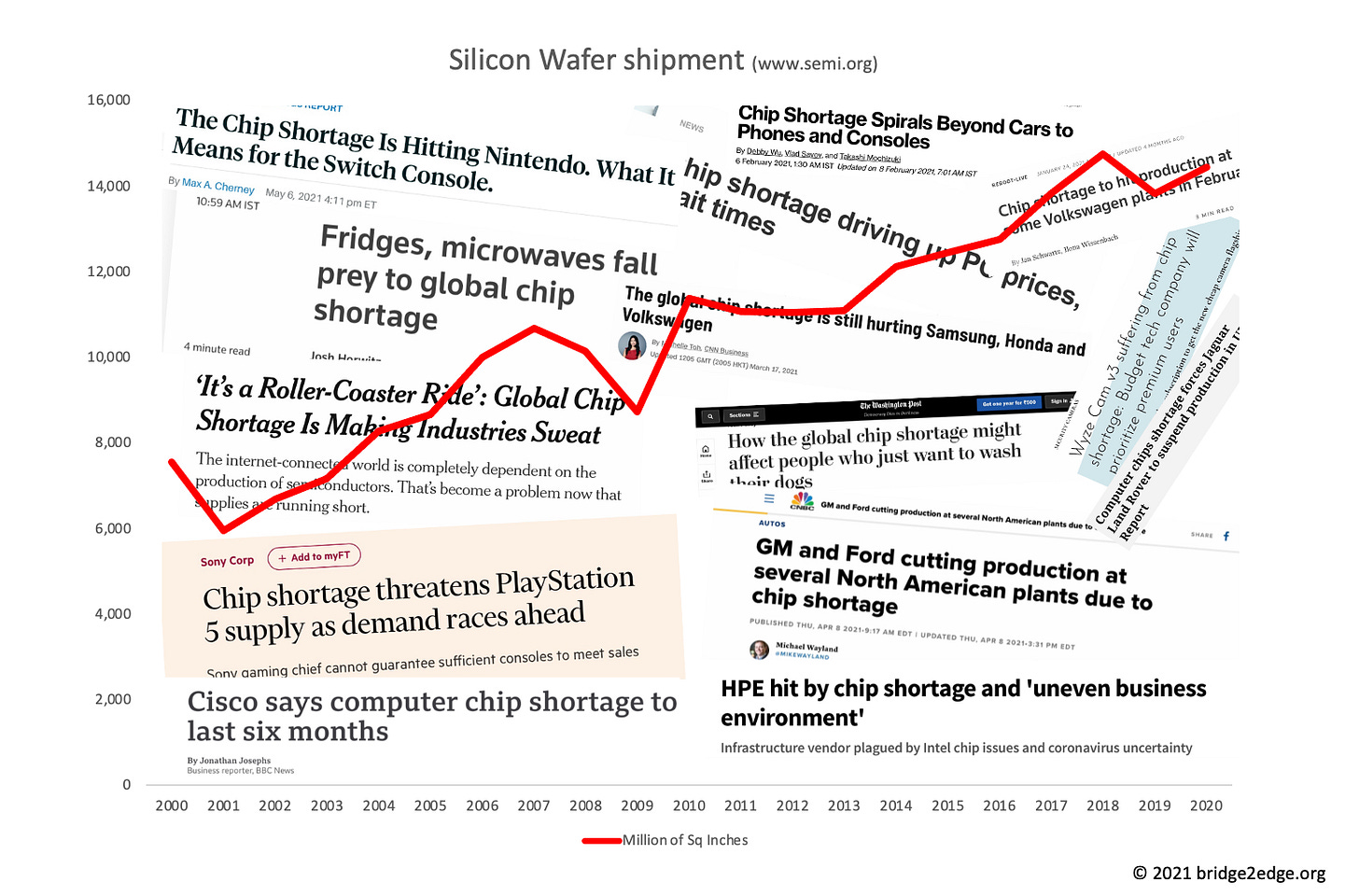

Part 1 discussed various reasons that caused the unprecedented semiconductor chip shortages and the disruption they caused to supply chains. Please go through it in case you have missed it. In this, we would be looking into tactical and strategic approaches across key management processes within the supply chain to address the challenges.

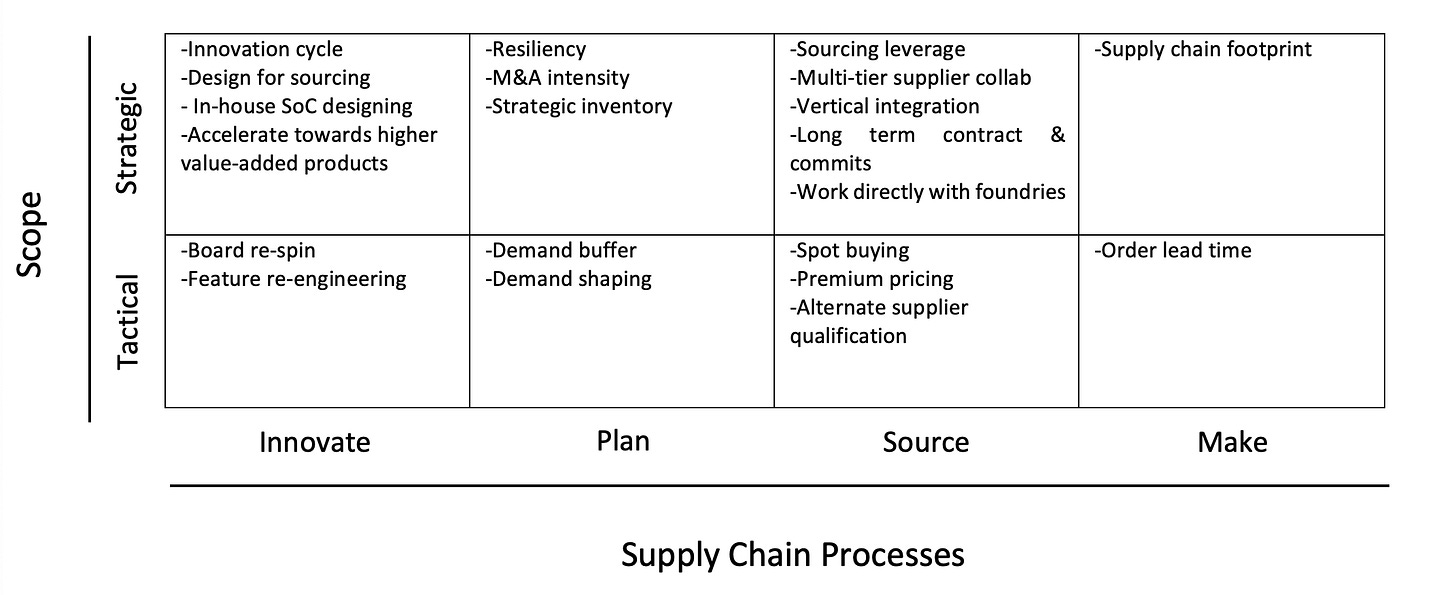

A 4x2 framework for addressing semiconductor shortage related supply chain disruptions

Here is a 4x2 framework that would be explored further to mitigate risks related to semiconductor device shortages.

Innovate

This is where new products are managed through scale, sustain and decline while working closely with engineering/product development. It is critical for the manufacturers to understand that their innovation cycle could be different from semiconductor manufacturers.

A typical car model could be in the market for 10 years, a new iPhone comes out every year, a new data center server hits the market every 1-2 years, wireless routers get introduced every 2-3 years. Semiconductor devices typically are in line with data processing and communication electronics (~ 2 years), which is their biggest market (64% of the business as per this Deloitte report). More the gap in the innovation cycle (auto vs chips), serious consideration needs to be given to the component roadmap and new product introduction.

Semiconductor companies allocate more of their capacity to cutting edge high margin products. Three semiconductor fab majors TSMC, Samsung, and Intel are investing hundreds of billion dollars into new fabs with the latest technology nodes (10 nm, 5 nm, and 3 nm) per EETimes report. It is critical for their customers to align their product and commodity strategy considering the new fab investment and capacity allocation strategy of their semiconductor suppliers.

“..However, there's a possibility that the semiconductor shortage will be prolonged, so we are accelerating the shift to higher value-added products that we have been advancing..” – Hiroki Totoki, Executive Deputy President and CFO, Sony Group Corp.

Semiconductor component shortage is the new normal for the near future. Designers need to use the best components that can be sourced from the market without any serious material shortages. Essentially design the product for sourcing as well. Accelerating towards higher value-added products like what Sony did could help secure semiconductor parts.

At a tactical level, re-spinning PCB design to remove most constraint chips and using alternates can be done. Also, feature re-engineering like dropping navigational systems, etc adopted by various automobile makers like Nissan could address short-term challenges.

Plan

Natural calamities/accidents like a fire at Renesas factory in Japan or a drought in Taiwan affecting semiconductor fab output could disrupt supply chains heavily. Geopolitical factors like the USA vs China's race to achieve supremacy in high technology space, where the semiconductor is a foundational aspect, would place restrictions on goods flow. A de-risking strategy to supply chain network planning is key.

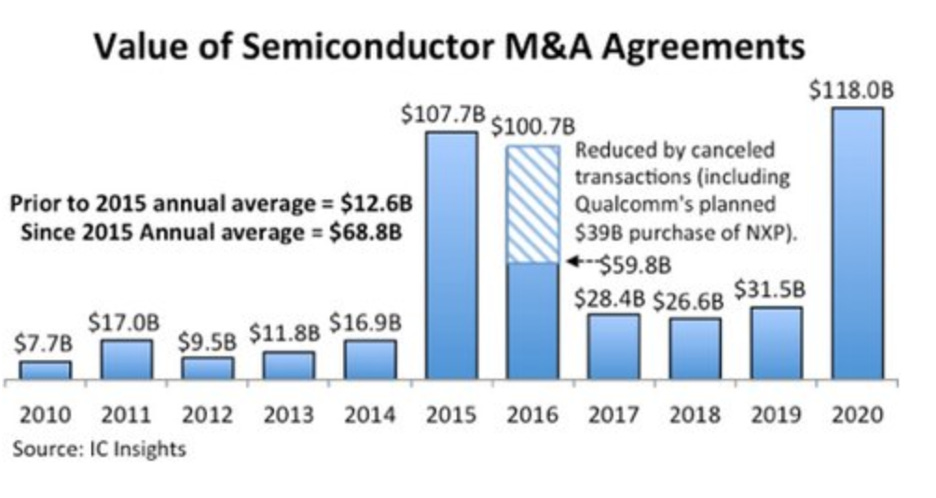

Post-2015, there was a high level of M&A activity in the semiconductor space as shown below. This trend shot up to a new level in the pandemic hit in the year 2020, for example, NVIDIA’s $40B acquisition deal to buy ARM from Softbank. This consolidation of semiconductor suppliers affects the balance of power and needs to be considered while developing the commodity and component supplier roadmap.

The auto industry’s use of just In time inventory policy, especially on semiconductor components, that has a longer lead time in months and shorter innovation cycle did not work well during this pandemic time.

It is clear that a one-size-fits-all inventory strategy won’t work and need a segmented approach. Aggressive lean inventory strategy on semiconductor components affected many auto giants seriously causing plant/line shutdown. Toyota managed the semiconductor shortage very well due to the strategic buffer inventory (4-6 months) they held for key semiconductor components

Planning to hold finished inventory buffering for high runner products is key to address order lead times. Moving customer demand towards products that show quicker recovery to the impact of semiconductor shortage would be a good tactical approach.

Source

It is important for any company to understand the leverage they have with suppliers. Look at the auto industry, they are less than 10% of overall semiconductor volume.

"The automotive industry is a small customer (less than 10%) of the overall semiconductor volume and not used to securing semiconductor manufacturing volumes upfront, hence its current exposure to a shortage is higher compared with sectors that do secure production volumes with purchase orders well ahead," Ondrej Burkacky, Partner, McKinsey

Auto manufacturers are used to having their entire supplier ecosystem around them, but semiconductor suppliers do have choices. Understanding this and coming up with an appropriate sourcing approach is critical.

“So it is key to have the communication with our suppliers, including not just the Tier 1 suppliers, but Tier 2 and so forth so that we can have -- be aligned in working together” – Kenta Kon, CFO, and COO, Toyota Motors Corp.

It is no longer sufficient to work with only tier 1 semiconductor suppliers. For many manufacturers, this could be Avnet, Arrow, Future, or other semiconductor distributors. It is important to go beyond this layer to communicate and collaborate with device manufacturers (Fabless/IDM/Foundries).

“Sourcing shifts. Companies along the value chain are likely to revise their sourcing strategies. For semiconductor players, this might involve further leveraging foundries and decreasing their reliance on critical suppliers.” - McKinsey & Company report

Vertical integration or working directly with foundries is becoming a popular strategy used by big companies. Apple got into this with their own silicon SoC (system on chips) A4 working with Samsung. Now they have a deep relationship with TSMC, another giant in the foundry business. Latest to join this is Google as they have announced custom silicon Tensor SoC for their new Pixel range of phones. FAANGS and other big corporates designing in-house SoCs working with foundry majors like TSMC, Samsung, Intel, etc is definitely a space to watch out for.

Long-term contract and purchase order commit is definitely a great strategy to ensure semiconductor capacity and components for your organization. The key here is not only to give a long-term view into your demand but stick to it, forecast accuracy/commit accuracy is very important. Building a trust-based relationship with your semiconductor suppliers would be very much needed.

At the tactical level, spot buying, paying a premium, alternate supplier qualification, etc are standard approaches used to work through the shortages.

Make

Supply chain footprint needs to address risks related to natural calamities as well as geopolitics. Be it a tariff war between major nations or a race to gain technology supremacy or self-sufficiency, relationships between nations/regions are key factors while designing a supply chain footprint. Given that semiconductors would power the cutting edge technologies, it is important to decide on the right strategy for supplier hubs, manufacturing locations, and forward/reverse logistics centers.

Given the longer replenishment time for semiconductor parts, especially post-pandemic where some devices are close to 52 weeks component lead time, it is important that manufacturing yields are monitored and managed well. Every effort should be made to ensure we don’t lose scarce semiconductor components to manufacturing processes and quality issues.

Need for learning organizations

Various industries are still grappling with the semiconductor chip crisis and this is expected to continue for many more months. Every crisis is a great opportunity to re-look at how supply chains are run and make changes, both tactical as well as strategic to successfully manage the disruption. More importantly, ensure creating learning organizations that encourage continuous learning, which would help prepare for future challenges.

"We are as strong as weak (supply of) chipset!"

Venkitesh, well written articles. Your research, deep experience & understanding of the domain is quite evident. Crisp & quite comprehensive for me to get a broader view of this chips issue. Looking forward for many such insights.

During WFH, as we were crunching LAYS Chips one-more pandemic fall-off was cooking (or Fab'ing) up. Suddenly all industries woke up to this challenge. Initially some thought it is like, ship struck in suez canal - will get rectified shortly!

In the maze of supply chain, one component's (yet crucial) non-availability outright questioned the much touted innovative manufacturing processes (like JIT, Lean). In my opinion that is OK. This would open up newer innovations, business models. For now, Auto or Consumer Electronics can't wait for too long & need find their new-normal sooner. Hope so!